Technical Analysis Is Used for Which of the Following Purposes

A technical analysis is the financial market actions study that uses charts in graphic form. Research into the demand and supply for securities based on trading volume and price studies.

Technical Analysis Beginner S Guide To Technical Charts

In order to forecast the direction of pricing by studying past data such as the price and volume.

:max_bytes(150000):strip_icc()/dotdash_Final_7_Technical_Indicators_to_Build_a_Trading_Toolkit_Oct_2020-02-8a5cea48dca24fcfa2cdb6c975f2a171.jpg)

. Tutorial 10 and 11 Topic 6 91 What is the purpose of technical analysis. These types of securities display clearer trends than equities and bonds do. By processing historical market data of any instrument you can try to anticipate how it should be traded.

The purpose of technical analysis is to carry out price forecasts. Government regulators are more likely to intervene in these markets. It focuses on how stick prices are moving and how powerful these moves are.

Technical analysis is a method of forecasting the direction of financial market prices through the evaluation of historic price and where available volume data. Differentiate among proposal analysis techniques. To assess progress in meeting technical plans and schedules.

Unlike FUNDAMENTAL ANALYSIS technical analysis is not concerned with the financial position of. TA combines both the use of past information and feeling to value a security. Fundamental analysis however takes a more formal approach.

Technical analysts do not put importance on the fundamental factors that affect market price. Technical analysts use charts to identify and project price trends. Technical analysis is based solely on the data generated by the market and by the actions of.

This type of analysis is based on the assumption that the past momentum of prices serves as a valuable indicator of their future value. Question 22 1 point Which of the following is true of Technical Analysis. The difference in yields on stocks and bonds.

The difference is the use of financial statements to value equities. This is simple quiz might take 10 Mins to complete to test you basic understanding about Technical Analysis. Instead technical analysis can help investors anticipate what is likely to happen to prices over time.

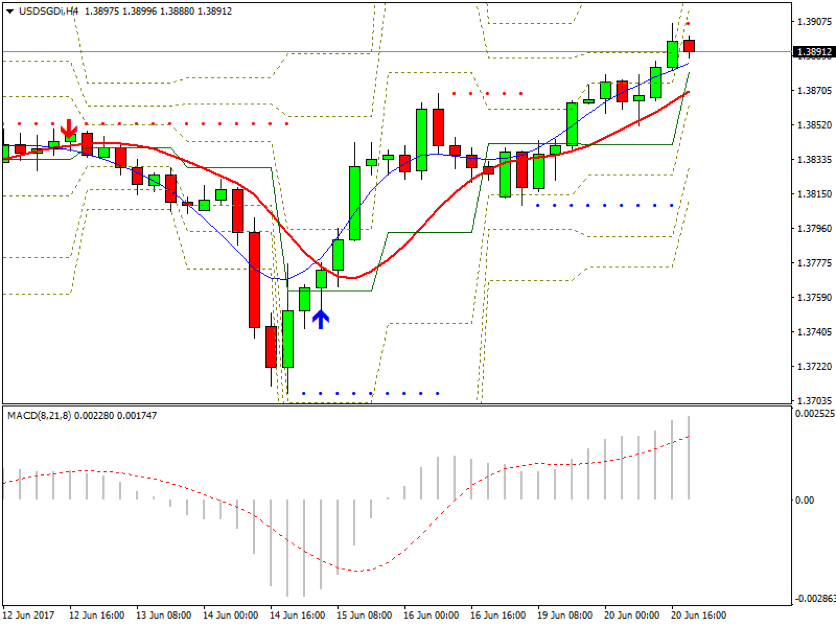

Technical Analysis is a method of analyzing securities such as stock commodities etc. This is also known as chart analysis. A longer term moving average.

Still while fundamental analysis focuses on the intrinsic value of the stock technical analysis focuses on the past. The Market Discounts Everything A major criticism of technical analysis is that it only considers price movement ignoring the fundamental factors of the company. The difference in a short-term moving average and.

All that is known or can be known is in the price. Technicians look at the changes in price that occur over a certain time period. The difference in the number of shares sold short.

Technical analysis is used specifically for determining the probable cost of performance for each offeror. Technical analysis employs statistical methods to evaluate financial instruments. There are several premises in favor of the reliability of technical analysis that are based on the experience and prolonged observation.

Like weather forecasting technical analysis does not result in absolute predictions about the future. Both methods are used for evaluating the stock and prediction of future stock prices. Technical analysis is the practice of valuing stocks on past volume and pricing information.

Technical Analysis Quiz Level 5. Valuation models cannot be used to determine fundamental intrinsic value for these securities. What is Technical Analysis.

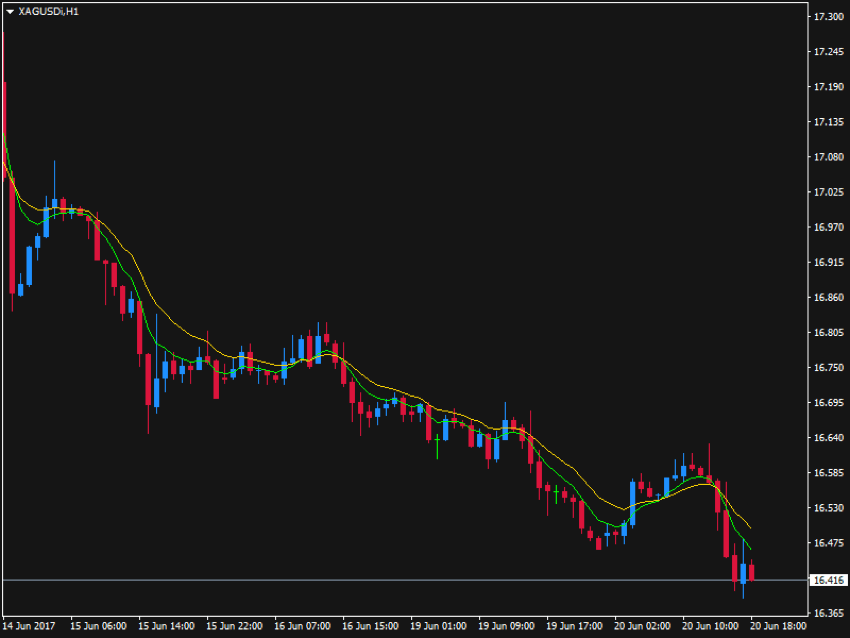

As you would expect that the stocks price of course depends on companys fundamentals however there are certain market driven data mixed with emotions of the buyerseller which throws a lot of interesting charting scenarios. Define key terms used in contract pricing Accurate complete and current as of a date before contract award. Technical analysis is primarily the visual illustration of the tussle between buyers demand and sellers supply.

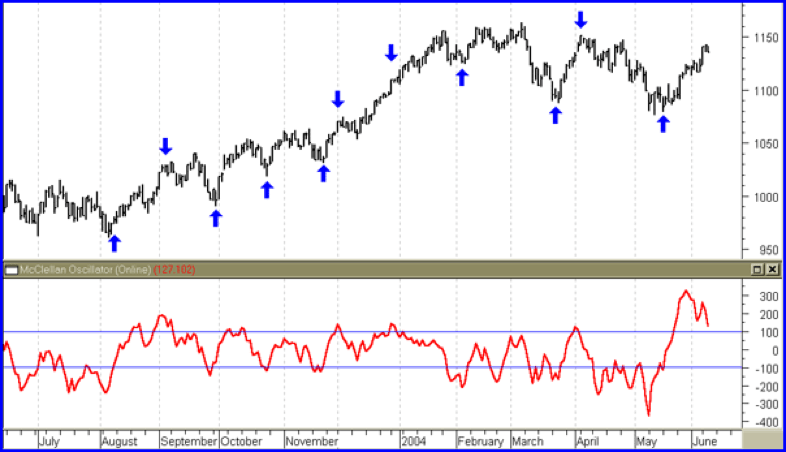

Note how it can be helpful in timing investment decisions. On the other hand technical analysis is a methodology of stock valuation which evaluates a stock based on charts and trends and predicts the future price of the stock. To assess technical progress towards meeting Stakeholder Requirements.

7 Certified cost or pricing data is considered to be. Technical analysis is the process of examining a stock or securitys price movements trading volume and trends to determine how or when to trade it and predict its price movements. History tends to repeat itself.

O 1 Technical analysts examine corporate fundamentals as key to stock price prediction 2 It relies on historical price and volume data to forecast stock prices 3 Technical analysis assumes that financial markets are strong-form efficient 4 Insider information is a. Technical analysis is therefore not concerned with the underlying value of a security but. The market discounts everything.

Explain how and why it is used by technicians. These changes are displayed in a graphic form called charts. Price moves in trends.

92 Can the market really have a measurable effect on the price behavior of individual securities. To select methods to be used to analyze alternatives To assess if an end product meets its design-to requirements To. This can be take by any individual who has trading instrument.

8 True or False. The moving average convergence divergence indicator. A basic premise of the technical approach is that market action discounts everything.

Technical Analysis Technical analysis is primarily the visual illustration of the tussle between buyers demand and sellers supply. Why is technical analysis especially useful in the analysis of commodities and currencies. Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements.

The Results will be sent to your Email ID after successful completion. Additionally it identifies trading opportunities based on historical data of price and volume. As you would expect that the stocks price of course depends on companys fundamentals however there are certain market driven data mixed with emotions of the buyer seller which throws a lot of interesting charting scenarios.

The field of technical analysis is based on three assumptions. The difference in yields between high and low. 97 What is the random walk hypothesis and how does it apply to stocks.

Pure Power Picks On Instagram Who Uses Technical Indicators With Their Sto In 2022 Technical Analysis Charts Forex Trading Strategies Videos Stock Trading Strategies

:max_bytes(150000):strip_icc()/dotdash_Final_Technical_Analysis_Strategies_for_Beginners_Sep_2020-01-412a1ba6af834a74a852cbc32e5d6f7c.jpg)

Technical Analysis For Stocks Beginners Overview

Xauusd Chart Forecast Technical Analysis Charts Patterns For Trader Technical Analysis Charts Technical Analysis Analysis

Top 7 Technical Analysis Tools In 2021 Technical Analysis Tools Technical Analysis Analysis

5 Essential Indicators Used In Technical Analysis Binance Academy Technical Analysis Technical Analysis Indicators Fundamental Analysis

Technical Analysis Beginner S Guide To Technical Charts

:max_bytes(150000):strip_icc()/dotdash_Final_7_Technical_Indicators_to_Build_a_Trading_Toolkit_Oct_2020-02-8a5cea48dca24fcfa2cdb6c975f2a171.jpg)

Top 7 Technical Analysis Tools

Gbpjpy Intraday Forecast Forex Forecast City Technical Analysis Charts Forecast Forex

Dell Trading Computer 4monitor Intel Xeon 3 70ghz Maxturb 1tbssd Dvdrw W10 Ebay In 2021 Financial Management Used Computers Trading

Which Of These Two Styles Do You Prefer To Use When Trading Technical Analysis Is The St Stock Trading Learning Fundamental Analysis Technical Analysis Charts

Day Trading Strategy Based On Following Institution Price Action In 2022 Day Trading Trading Strategies Trading

/dotdash_Final_7_Technical_Indicators_to_Build_a_Trading_Toolkit_Oct_2020-01-c7ccbebd39954ae6897d51a60037b888.jpg)

Top 7 Technical Analysis Tools

Always Follow The Trend Trading Charts Stock Trading Learning Intraday Trading

Technical Analysis Patterns The Complete Guide The 5 Ers

/dotdash_Final_How_to_Use_a_Moving_Average_to_Buy_Stocks_Jun_2020-01-3b3c3e00d01442789e78a34b31e81d36.jpg)

How To Use A Moving Average To Buy Stocks

Technical Analysis Beginner S Guide To Technical Charts

Ctrader Fibonacci Tool Trend Trading Trading Charts Technical Analysis Charts

Pin By Beautiful World On Forex Technical Analysis Step Guide Learning